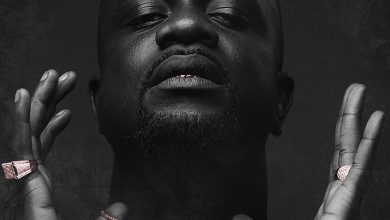

I’m not a Christian – Okyeame Kwame

Even though he grew up in a Christian home with Catholic and Methodist parents, renowned Ghanaian rapper Okyeame Kwame says he is not a Christian.

He mentioned that he is presently an omnist who derives his faith and inspiration from every religion.

The Oxford dictionary defines an Omnist as a person who believes in all faiths or creeds, a person who believes in a single transcendent purpose or cause.

According to the Woso hitmaker, real name, Kwame Nsiah Appau, who was speaking with Joy Entertainment’s Kwame Dadzie in an interview, he doesn’t subscribe to one religion.

“I was born as a Christian in the Methodist Church and then I grew up in the Christian faith until I was maybe 14 years.

“Most of my values are Christian. My father was a Catholic. My mother went to the Methodist Church so I grew up doing catechism and all that. I went to an Anglican school so most of my socialisation has been very Christian. But in my adult life, I don’t think I can call myself a Christian in the full sense. I call myself on omnist,” he said.

The artiste who is known for a number chart topping songs such as ‘Yeeko’, ‘Faithful’, ‘Small Small’ and ‘Made in Ghana’ explained that when it comes to loving nature, respecting trees and rivers, he refers to the African tradition; his love for animals makes him a Buddhist; when it comes to the ‘love your neighbor as yourself’ teaching in the Bible, he is Christian; but he also becomes a Muslim for his extreme respect to God and owing all power for him.

He added that he does not want to limit himself to one religion so that he cannot tap into the virtues of the other religions.

As part of getting himself acquainted with various religions, the father of two met with Sadhguru, the founder of the Insha Foundation, when he visited India earlier in January this year.

Source: graphic online