BoG denies introduction of ¢500 coin, note

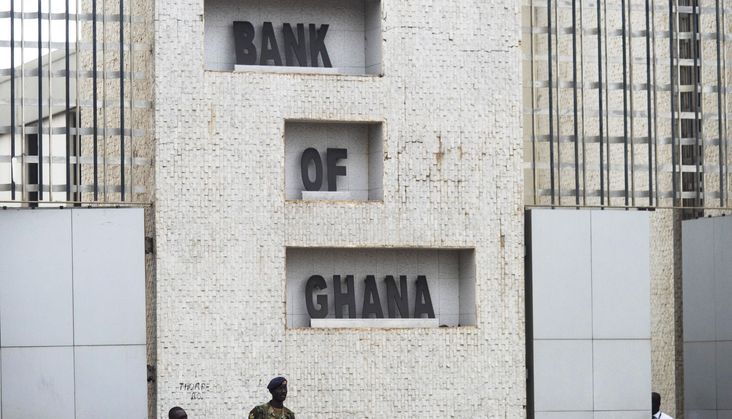

The Bank of Ghana (BoG) has debunked reports of issuing ¢500 coin, insisting it has no immediate plans of issuing higher denomination for circulation.

There have been reports that the Bank is working to introduce the coins – samples of which have been circulated on social media platforms.

Speaking to the media, the Director for Currency Management at the BoG, Dominic Owusu said the reports are false.

He pointed out that the BoG will always embark on an extensive public and media education before it introduces new notes or coins into circulation.

“When there is a currency issuance or change, the Bank of Ghana will come with an appropriate press release to inform the public. We saw on social media that the central bank will issue a ¢500 note or coin but the bank has not done any such thing. So it’s not true, “he said.

Mr. Owusu explained that the introduction of a new currency or withdrawal of same is an important exercise that is always thoroughly planned by the Bank of Ghana before executed.

This, he said enables the public to understand the value and usage of such currencies.

He urged the public to disregard social media stories that suggest that the Bank of Ghana is introducing new currencies without official statement from the bank.

Touching on reports that the one pesewas coin is no longer a legal tender and it’s out of circulation, Mr. Owusu maintained that the coin should be used for transactions and must be accepted by customers.

“That’s why we are here, so help us to circulate those information that those coins are still legal tender and must be used for transactions. The central bank has not demonetize the one pesewa coin,” he maintained.

The Bank of Ghana however said it remains committed to embarking on various sensitisation programmes to educate Ghanaians on how the currency can be handled.

“We want the education out there for people to learn how to handle the cedi not to worn out. That’s why you journalist are here and I want you to help the central bank in that quest. The bank is also doing its part and will make sure all is done to save the cedi”, he added.

Source: myjoyonline